The real estate closing process is a complex yet vital phase requiring coordination among buyers, sellers, agents, lenders, and lawyers. It involves preparing critical documentation like loan applications, disclosures, and contracts, while adhering to local regulations. Effective communication and clearly defined roles are key to success, with agents guiding document preparation and facilitating collaboration. Challenges such as document management issues and miscommunication can be mitigated by organized document storage, regular updates from agents, and clear role understanding, leading to a smoother and more satisfying transaction experience.

Guiding clients through the real estate closing process is an essential service that ensures a smooth transition from buyer to homeowner. This article offers a comprehensive guide, delving into the intricacies of the closing process, highlighting critical roles and responsibilities, and addressing common challenges faced by both buyers and sellers. By understanding these key aspects, you’ll be better equipped to navigate the complexities of real estate transactions successfully.

Understanding the Closing Process in Real Estate

The closing process in real estate is a crucial step for both buyers and sellers, marking the finalization of a property transaction. It involves multiple parties, including the buyer, seller, their respective agents, and often, lenders and lawyers. This intricate process ensures that all legal and financial aspects are settled, providing a seamless transition from ownership transfer to occupancy. Understanding each stage is essential for a smooth closing experience.

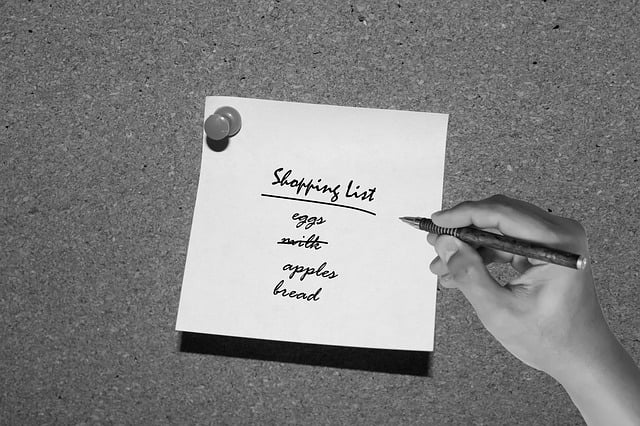

Buyers and sellers must be prepared to provide specific documents and complete necessary paperwork, such as loan applications, disclosures, and contracts. These steps vary based on location and type of property but generally include verification of funds, title searches, and home inspections. Effective communication among all involved parties is vital to navigate any potential challenges or delays, ensuring a successful closing.

Key Roles and Responsibilities for a Smooth Closing

In the real estate industry, a smooth closing process relies on clear definitions of roles and responsibilities. The real estate agent plays a pivotal role in guiding clients throughout the entire transaction. They ensure all necessary documents are prepared, accurately representing the property’s condition and terms agreed upon by both parties. The agent also facilitates communication between buyers, sellers, lawyers, and lenders, ensuring everyone is aligned and informed.

At the closing table, the real estate attorney takes center stage, meticulously reviewing and processing legal documents to protect their client’s interests. They handle contract revisions, verify all terms, and ensure compliance with local regulations. The attorney also manages any potential disputes that may arise, providing a crucial safety net for both buyer and seller. Effective collaboration between these key players is essential to make the closing process seamless, ensuring satisfaction for all involved parties in the real estate transaction.

Common Challenges and How to Overcome Them During the Closing Process

The closing process in real estate can be fraught with common challenges that often cause delays and frustration for both buyers and sellers. One of the primary hurdles is document management. Many clients struggle to keep track of numerous forms, contracts, and disclosures required at each stage. To overcome this, encourage clients to create a dedicated folder or use digital tools designed for streamlined document organization.

Another challenge arises from miscommunication or misunderstandings about expectations. Clear communication is vital throughout the process. Real estate agents can help by providing regular updates, explaining each step in simple terms, and ensuring all parties understand their roles and responsibilities. This proactive approach fosters trust and helps to smoothly navigate any potential obstacles that may arise during the closing.